Few things are more frustrating than watching your project unravel because of preventable risks. Missed deadlines, rising costs, and low team morale can quickly derail success. Then everyone starts recommending risk analysis when things go south.

The good news is it does not have to be this way. With the right strategies, you can anticipate challenges and safeguard your efforts.

This guide provides practical tools and proven techniques to help you identify, assess, and mitigate risks. Protect your hard work and take control of uncertainty today.

What is risk analysis?

Risk analysis is the process of identifying, assessing, and prioritizing potential risks that could affect your business objectives or project operations. It evaluates uncertainties, including threats and opportunities, to determine effective responses.

At its core, risk analysis helps your organization understand and navigate uncertainty. It minimizes negative impacts while identifying opportunities, making it a key tool for both risk management and strategic planning.

Why risk analysis is essential

Risk analysis provides a roadmap for resilience and success. It offers several benefits that include:

- Clarity in uncertainty: A structured approach to assess risks.

- Proactive decisions: Actions can be taken before risks materialize.

- Efficient resource use: Focuses efforts on critical risks.

- Stakeholder trust: Builds confidence with investors and clients.

Without risk analysis, your team may often resort to reactive problem-solving, which is costly and inefficient. Today, proactive risk analysis is essential for sustainability in your projects and operations.

Who benefits from risk analysis?

Risk analysis supports business leaders, project managers, compliance officers, and policymakers in managing risks. It also addresses untapped areas like climate change adaptation, emerging technologies such as AI and IoT, and supply chain resilience.

IT professionals apply it to cybersecurity, while investors and entrepreneurs use it for decision-making. Its versatility ensures relevance across industries, helping tackle both well-known and underexplored risks effectively.

Real-world examples of risk analysis

To understand the power of risk analysis, consider its application in real-world scenarios:

- In finance: Banks use risk analysis to evaluate credit risks and ensure compliance with regulatory standards like Basel III. Stress testing helps them prepare for market shocks.

- In healthcare: Hospitals assess risks to patient safety, such as surgical errors or equipment failures, to improve care quality and comply with health regulations.

- In cybersecurity: Organizations perform threat modeling to identify vulnerabilities and implement measures to prevent data breaches or ransomware attacks.

- In construction: Risk analysis helps manage project risks like cost overruns, delays, or environmental challenges, ensuring projects are completed safely and on time.

These examples demonstrate that effective risk analysis is not just about avoiding losses. It is about enabling growth, innovation, and operational excellence in your organization.

Incorporating the risk analysis matrix into your strategy

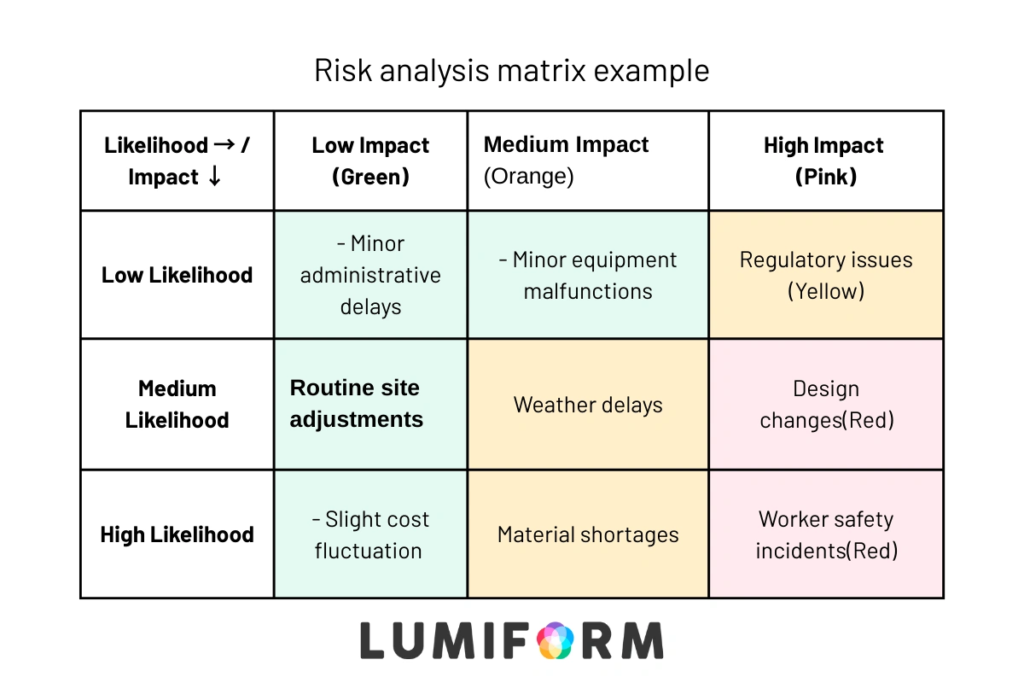

A risk matrix is a practical tool for assessing and prioritizing risks based on likelihood and impact. It organizes your business/project risks into categories. Its structure helps your organization’s decision-makers focus on critical issues while maintaining a clear overview.

This simplicity makes it useful for both experts and non-specialists.

Color code summary

- Green: Risks that are low in severity. These require occasional monitoring but do not demand immediate action.

- Orange: Risks with moderate severity. These need proactive management to avoid escalation.

- Pink: Risks with high severity. These demand priority attention and immediate mitigation.

Here’s a free risk matrix template you can customize and further expand for your use case.

How to use a risk analysis matrix: Two dimensions

The matrix uses two dimensions: likelihood, which measures the probability of a risk, and impact, which evaluates its severity. Risks are placed on a grid divided into levels such as low, medium, high, or critical. This method simplifies decision-making, improves prioritization, fosters collaboration, and ensures accountability. Resources are directed toward the most urgent risks.

To create a risk analysis matrix, identify the potential risks (here are 40+ free risk assessment templates to help you). Evaluate the likelihood and impact of each risk, then plot them on the grid. Prioritize risks in the high-likelihood, high-impact category and develop strategies to address them.

Finally, regular updates and team collaboration ensure your matrix stays relevant and effective.

The value of the matrix

The risk matrix remains valuable because of its adaptability and ability to complement advanced tools like AI analytics. It connects technical insights with strategic decisions, helping organizations manage risks with clarity and confidence.

To unlock the full potential of a risk matrix, you must integrate it into your organization’s broader risk management processes. A key step is treating the matrix as a living document. Risks evolve over time, so the matrix should be updated regularly to reflect new threats or changes in the business environment.

For instance, emerging risks related to AI, cybersecurity, or global supply chains may require frequent reassessment.

Examples of risk matrices in action

The practical value of the risk matrix becomes evident when applied to real-world scenarios. Its flexibility allows it to adapt to both simple and complex environments:

- Simple 3×3 matrix for small projects:

A startup launching a new product uses a 3×3 risk matrix to assess potential risks. These include supplier delays, unexpected costs, and customer dissatisfaction. Each risk is evaluated for likelihood and impact, helping the team prioritize and allocate resources effectively. - Advanced 5×5 matrix for complex environments:

A construction company employs a 5×5 risk matrix to evaluate risks for a large infrastructure project. Risks like regulatory delays, equipment failures, and worker safety incidents are analyzed in detail. This enables the company to allocate resources efficiently and ensure compliance with safety standards.

These examples demonstrate how the risk matrix can scale to meet the needs of different projects, from small business initiatives to high-stakes operations.

Foundations of risk analysis: Key components

Risk analysis has three core components:

- Risk identification: Spotting potential risks by understanding goals, operations, and the external environment. Common methods include brainstorming and data analysis.

- Risk assessment: Analyzing risks to determine their likelihood and impact, helping prioritize critical threats.

- Risk evaluation: Comparing risks against criteria like risk tolerance to address key issues and monitor minor ones.

These steps create a structured process for better decisions and resource use.

Types of risks to address

Organizations face diverse risks from both internal and external sources. A thorough risk analysis includes:

- Financial risks: Market volatility, credit defaults, currency shifts, and liquidity issues.

- Operational risks: Process failures, equipment breakdowns, or supply chain disruptions.

- Strategic risks: Risks tied to decisions like entering new markets or adopting new technologies.

- Compliance and legal risks: Regulatory changes, lawsuits, or failing to meet industry standards.

- Environmental risks: Natural disasters, climate impacts, or resource shortages.

- Technological risks: Cyberattacks, data breaches, or tech implementation failures.

- Reputational risks: Negative public perception, social media backlash, or loss of trust.

Addressing these risks ensures a well-rounded strategy that minimizes vulnerabilities.

The role of risk tolerance and appetite

Risk tolerance and appetite define acceptable risk levels:

- Risk tolerance: The variation in outcomes an organization accepts. For example, avoiding risky investments.

- Risk appetite: The broader willingness to take risks for strategic goals, such as innovation.

Clear definitions align decisions with goals and prevent over-caution or recklessness.

Common frameworks and standards

Frameworks guide risk analysis. ISO 31000 outlines principles for managing risks. COSO ERM developed by the Committee of Sponsoring Organizations of the Treadway Commission/Enterprise Risk Management, links risk management to strategy. NIST focuses on cybersecurity threats. These frameworks ensure consistency and compliance. Organizations should choose based on size, industry, and needs.

Bridging theory and practice

Risk frameworks must be practical. Small businesses can simplify ISO 31000 for key risks. Industries like healthcare or finance often customize frameworks for specific challenges. A risk-aware culture ensures your employees address risks openly and integrate analysis into daily operations.

Overlooked aspects of risk analysis

Interconnected risks, such as a cyberattack causing financial and reputational damage, are often underestimated. Risks also evolve due to technology or market changes, requiring regular updates. Opportunity risks, such as missing growth chances, are often ignored. Balancing threats and opportunities ensures agility.

The risk analysis process: A step-by-step guide

Scenario: Managing risks in a construction project

You are managing the construction of a commercial office building with tight deadlines and multiple stakeholders. Risks like weather delays, safety incidents, and material shortages threaten progress, costs, and quality. A structured risk analysis process helps identify, assess, and mitigate these risks effectively.

Step 1: Identifying risks

The process starts with listing potential risks. For this construction project, risks include:

- Weather delays: Heavy rain could halt outdoor work.

- Material shortages: Delayed deliveries could stop progress.

- Worker safety incidents: Accidents could lead to injuries and delays.

- Regulatory issues: Permit or zoning problems could halt construction.

- Cost overruns: Rising expenses could strain the budget.

- Design changes: Late modifications could disrupt timelines.

Cross-functional teams, such as architects and contractors, help uncover risks. Historical data from similar projects also provides useful insights.

Step 2: Assessing risks

Each risk is evaluated for likelihood and impact:

- Weather delays: Likelihood: High; impact: Medium.

- Material shortages: Likelihood: Medium; impact: High.

- Worker safety incidents: Likelihood: Medium; impact: High.

- Regulatory issues: Likelihood: Low; impact: High.

- Cost overruns: Likelihood: Medium; impact: Medium.

- Design changes: Likelihood: Medium; impact: High.

A risk matrix helps categorize risks and focus on high-priority threats like material shortages and safety incidents.

Step 3: Prioritizing risks

High-priority risks for the project include:

- Material shortages: Delays could halt construction.

- Worker safety incidents: Injuries could cause delays and legal issues.

- Regulatory issues: Compliance failures could stop work entirely.

Weather delays and cost overruns are monitored but are secondary priorities.

Step 4: Mitigating and managing risks

Mitigation strategies reduce risk likelihood or impact. Management plans address risks if they occur:

- Material shortages: Use multiple suppliers and maintain buffer stock.

- Worker safety incidents: Enforce safety protocols and assign a safety officer.

- Regulatory issues: Conduct preemptive audits and consult legal experts.

These actions ensure readiness and minimize disruptions.

Step 5: Monitoring and reviewing risks

Risk monitoring keeps the team proactive:

- Key risk indicators (KRIs): Track supplier performance and weather forecasts.

- Regular reviews: Update the risk matrix weekly.

- Technology tools: Use project management software to flag delays.

For example, missed supplier deadlines trigger backup plans to avoid delays.

Challenges and solutions

Challenges include:

- Interconnected risks: Overlapping risks, like material shortages causing cost overruns, are often missed.

- Dynamic risks: Static assessments fail to capture emerging threats.

- Stakeholder resistance: Some may see risk analysis as unnecessary.

A holistic approach addresses interconnected risks. Regular updates ensure the matrix stays relevant. Streamlined tools simplify the process and encourage participation.

Why a structured process matters

A structured process reduces delays, cost overruns, and safety incidents. This approach helped identify and mitigate top risks, ensuring the project stayed on track. It builds accountability, fosters collaboration, and equips teams to handle challenges effectively.

Take action: Elevate your risk analysis today

Now is the time to act. Can you commit to refining your risk analysis process this month? Take the first steps today and see how addressing risks proactively reshapes the way your team delivers results.

Start today with Lumiform’s platform. Discover templates, automation, and advanced audits. Collaborate with your team to boost compliance, elevate standards, and improve key areas.

The tools are ready. Click here to put them to work!