From office supplies to drinks during client meetings, petty cash expenses can build up quickly. To keep records organized and well-maintained, you can use a petty cash form, where you can log transactions every time and track when to replenish your fund.

The six petty cash form templates below simplify the process for you, whether you’re looking to streamline your approval process or do thorough reconciliations at the end of every month. With these forms, you can cut down on inconsistencies and reduce the hassle of having to sort through receipts or rely on memory.

Petty cash forms for easy tracking

Using a clear, detailed form for each transaction lets you keep a running record that’s ready for auditing and budget adjustments:

Petty cash form

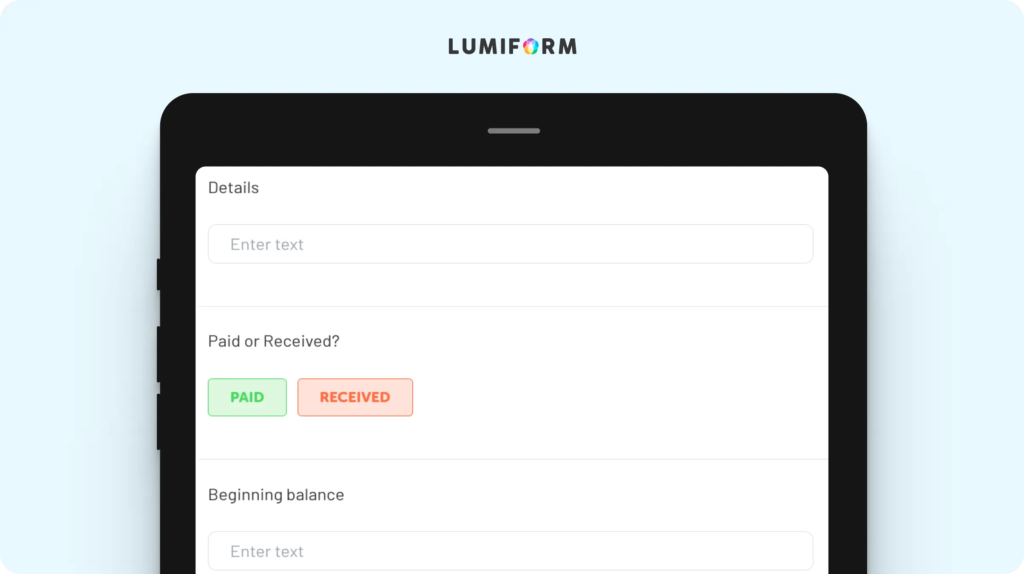

A petty cash form is your go-to for logging those small, day-to-day expenses that keep operations running smoothly, like office supplies or quick reimbursements. This template provides fields for expense details, amounts, and signatures to maintain thorough and accurate records. You can customize it to fit your department’s approval process or set up recurring fields for frequent expenses, helping you streamline tracking even further.Petty cash reconciliation form

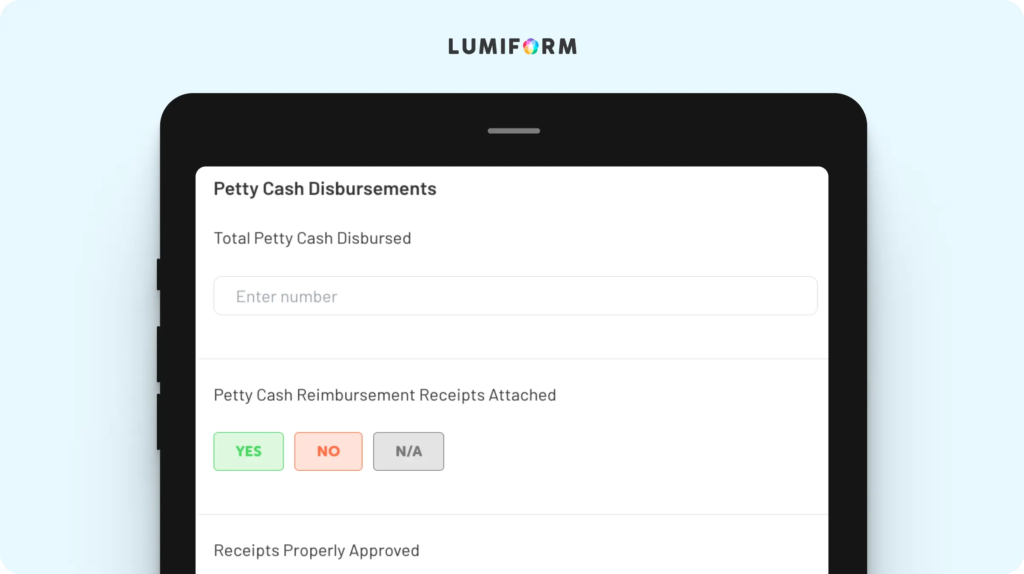

Use this petty cash reconciliation form to ensure your petty cash fund remains accurate. It enables you to balance what’s left against recorded transactions. With fields for starting balance, expenditures, and closing amounts, this template makes the reconciliation process quick and reliable. Tailor the form to request for extra descriptions or supporting photos so every expense is accounted for. By including subtotals and a final verification signature, this form gives you a clear financial snapshot at a glance, making reconciliations easier while minimizing errors.Petty cash log template

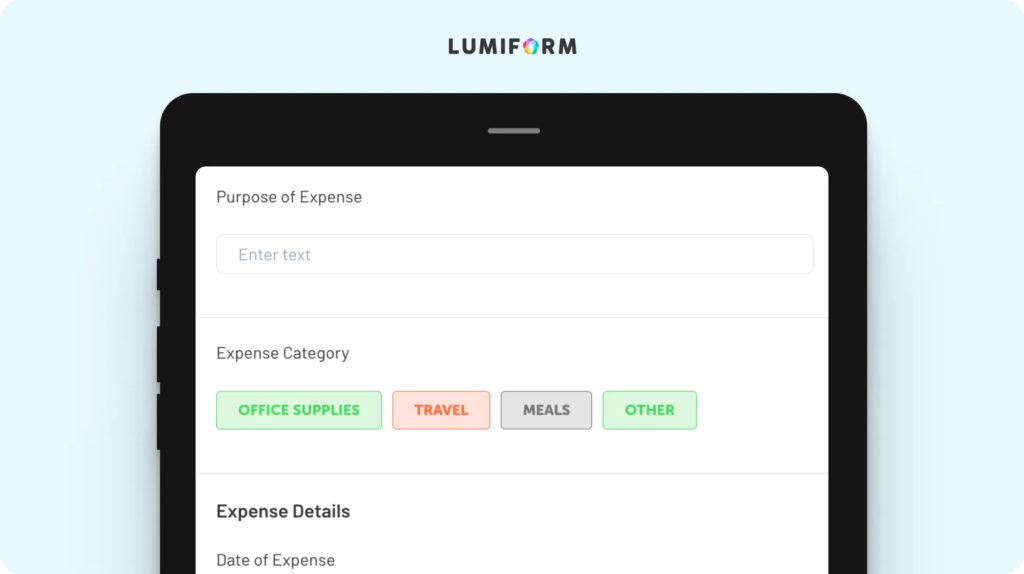

For a running account of petty cash transactions, this log template offers you a structured, easy-to-update format. Track each expense in real-time, with essential fields like date, purpose of the expense, and amount for clarity. There’s also space for comments so you can note extra details as needed. Adapt the log to fit your team’s needs by adding your own expense categories, giving you a quick review of where funds are going. This template keeps your petty cash system transparent, providing a clear trail for both day-to-day tracking and month-end summaries.Petty cash request form

This form makes it easy to submit requests before accessing petty cash. It has all the basics covered—requested amount, purpose of spending, and approval signatures—so you can have a quick, organized approval process. You can also add extra approval steps based on your workflow or tailor the form for certain departments. This leads to accountability from the start, with each expense pre-approved and documented clearly. A request form like this keeps spending organized and predictable, allowing managers to track budget allocations with ease.Petty cash replenishment form

When your petty cash fund is running low, this replenishment form simplifies the process of requesting for additional funds. You’ll need to write down the current balance and replenishment amount, then go through authorized approval, formalizing cash top-ups. Customize it to by adding instructions based on your organization’s budget or setting spending thresholds, so each refill follows the necessary protocols. With signatures included, this form not only keeps the fund topped up but also maintains a reliable paper trail.Petty cash tracking template

This template is ideal for keeping an organized, ongoing record, from tracking expenses to managing replenishments. With fields for date, amount, and purpose, it gives you an at-a-glance view of petty cash usage, helping prevent overspending and simplifying reconciliation. It also covers approvals and replenishment so you can conveniently update cash flow and maintain accurate documentation. Tailor the template to suit your team’s needs by adding your own approval steps.Petty cash log template (Hammersmith and Fulham Council)

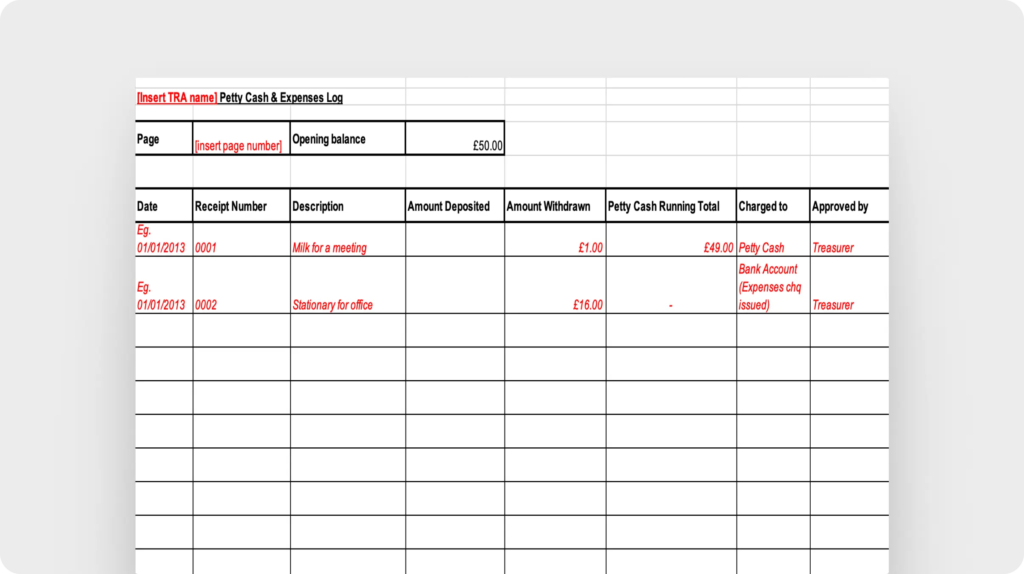

This template from the Hammersmith and Fulham London Borough Council comes in the form of an Excel spreadsheet. Its design is straightforward, allowing you to enter the date, amount, and description for each transaction. You’ll also track the amount deposited and withdrawn each time, with approval required for each transaction. At the bottom of the template, you can fill out the closing balance and add approval signatures. By using this template, you can keep every expense properly documented and reconciled and prevent discrepancies.

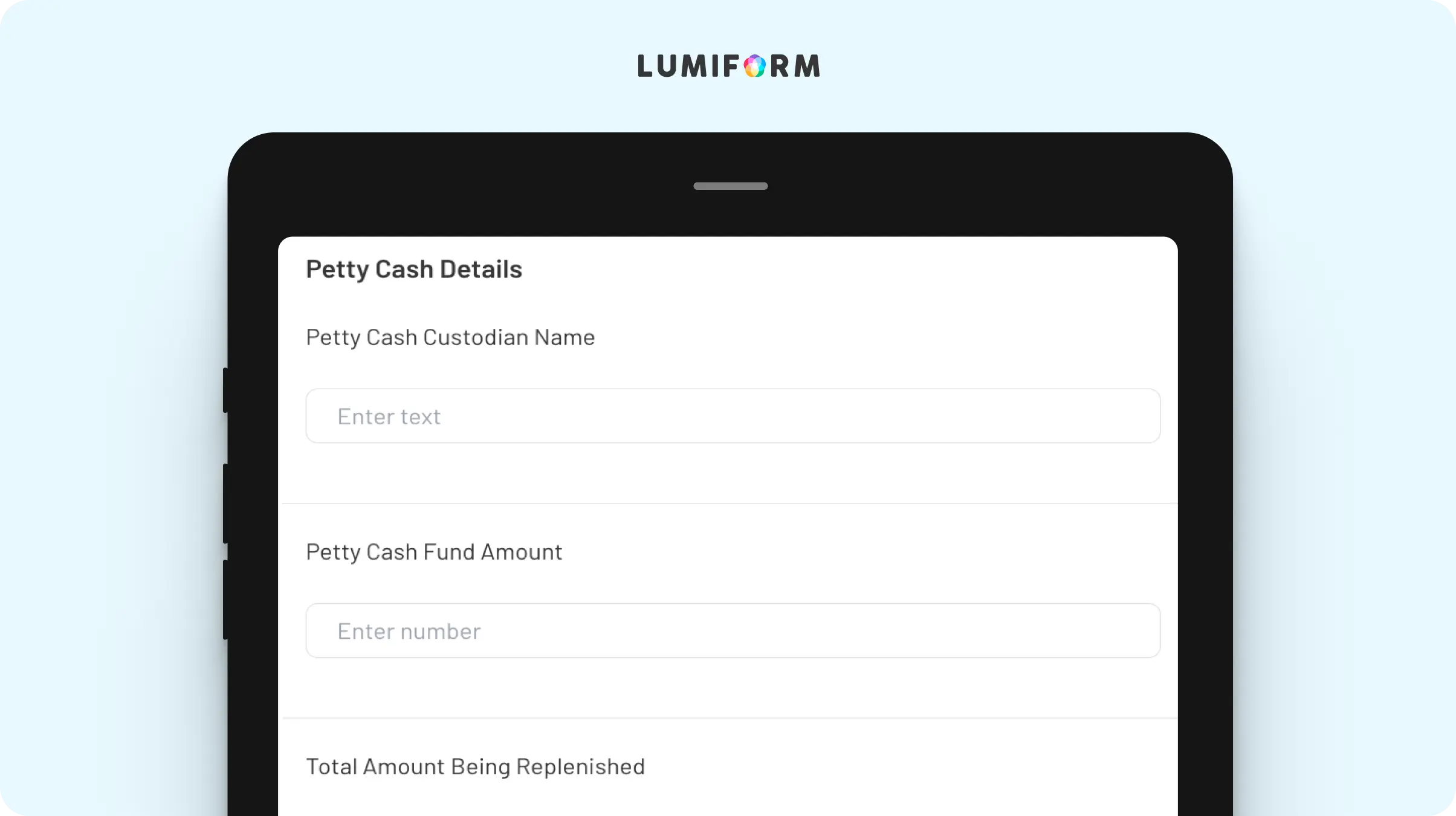

A quick guide to creating your petty cash form with Lumiform

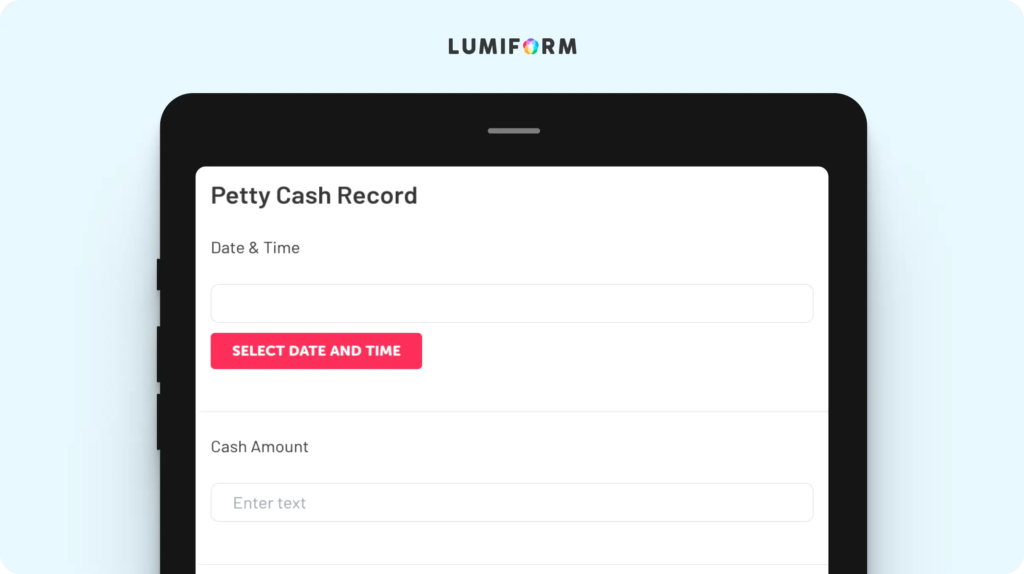

You can quickly get started with using your own petty cash form on Lumiform. Use the app’s drag-and-drop form builder to personalize templates and capture exactly what your team needs, from adding approval steps to specifying your own expense categories.

To make the form even more comprehensive, take advantage of diverse input types, which allow you to add dropdowns, text notes, and signatures. Team members can even attach pictures of receipts for each transaction.

Since the form is also available on mobile, team members can log and submit expenses anytime, anywhere, making it easy to record petty cash on-the-go. With built-in sharing and collaboration features, keeping track of changes and requesting for approvals are also faster.

With Lumiform’s data analysis and reporting tools, you can then review spending, spot trends, and complete month-end accounting quickly. This approach gives you a clear, customized petty cash system that’s thorough yet convenient for your team to use.